Extending a Car Loan in Canada: Everything You Need to Know

Extending a Car Loan in Canada: Everything You Need to Know

Posted on January 17, 2024

Life does happen to people, and sometimes, it might be difficult to repay your auto loans. Sometimes there are medical emergencies, car repairs, or a job loss that might strain your finances. Knowing full well that missing a loan can affect your loan, how can you mitigate this? Can you extend your car loan? Yes, you can!

In this article, we'll go over everything you need to know about extending a car loan, with some alternatives at the end that could make more sense depending on your financial situation.

Why Do People Extend Car Loans?

To lower the monthly payment: If you're looking to lower your monthly payment for your auto loan, you should consider extending your car loan.

By extending the time for repayment, you can lower the amount repayable every month. Although, the interest is likely to accumulate and grow at the end of the day.

However, it is easier to repay the loan while you balance your budget.

Benefits of Reducing Your Monthly Payment

There are many reasons why you might want to reduce your monthly payment. Some of them are:

Save more money: reducing your debt helps you save more money that can be used for other pressing demands, including servicing other debts.

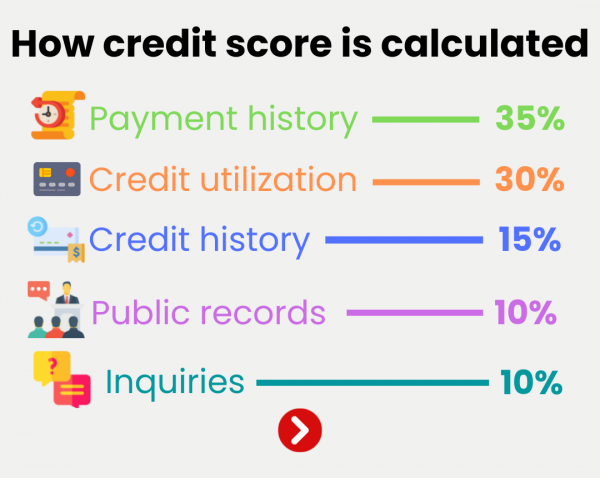

Strength of your credit: You can improve your credit by making payments on time which will be much easier with lower monthly payments.

Use Extra Funds To add to Your Savings: You can also access funds that will be invaluable for investment or savings.

How to Extend a Car Loan

Ask that the date of repayment be changed: If you find it difficult to repay your monthly loans due to unexpected circumstances, you can ask to change the loan repayment date.

Therefore, you can call your lender to negotiate a change in the repayment schedule, leading to the extension of your loan.

Ask for a payment extension or deferral: If you fall behind in your payment, you can simply ask for a loan extension or choose to defer your payment for a month or two. However, the payment extension is not automatic.

The lender of the financier has to assess your creditworthiness and determine if you qualify or not.

Regardless of the conditions attached to a car loan extension, they are possible and can be triggered just like other forms of loans.

Other Auto Loan Options

There are a few other alternatives to extending your auto loan that might make better financial sense.

They include:

Taking a payment holiday: While all lenders were told to offer payment holidays during the pandemic, most lenders offered the facility anyway. If you think your situation is temporary or just need to take a breath, this could be all you need. Just remember, interest still accrues even during the holiday!

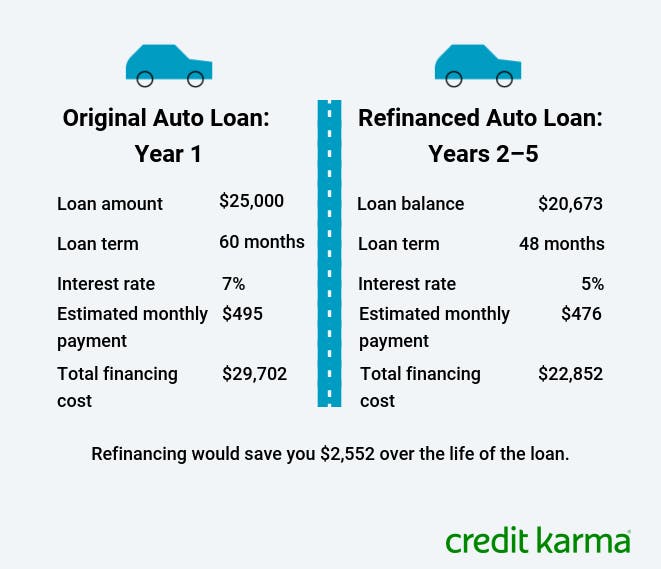

Refinance the auto loan: Depending on how far in you are, you could refinance your current loan with a cheaper one. If you have paid off some of the existing loan, you could apply for a cheaper one with lower monthly payments.

Transfer the loan – While less common, you can transfer your loan to someone else if you need to. If you can find someone to take it on and they would qualify for that loan, you could sign it over to them to complete the payments.

Sell the car – This isn’t something that is always possible but is an option. If you have another car or could sell the car and get a cheaper one, that could solve your problem. As long as you could pay the loan off and have enough left over to buy something else, this could work.

That's it! Thanks for reading. If you have any questions, please contact us here.