Car Loan With No Job: Are You Still Eligible For Approval?

Car Loan With No Job: Are You Still Eligible For Approval?

Posted on January 8, 2024

It’s one of those impossible situations. You need a car to get to work and you need work to get a car. So, what can you do? If your old car no longer works or you had a company car, how can you get around? Can you finance a car loan with no job in Canada?

Can You Finance a Car Loan With No Job?

The bad news is that unless you have alternative income sources, you won’t qualify for a car loan. You will need adequate income to be able to repay the loan. Without an income, you won’t be able to afford repayments.

The only way around that is if you have other income from investments, social security, pension, alimony or rental income.

If you have other sources and it is sufficient to help you finance a car loan with no job, you may be able to qualify.

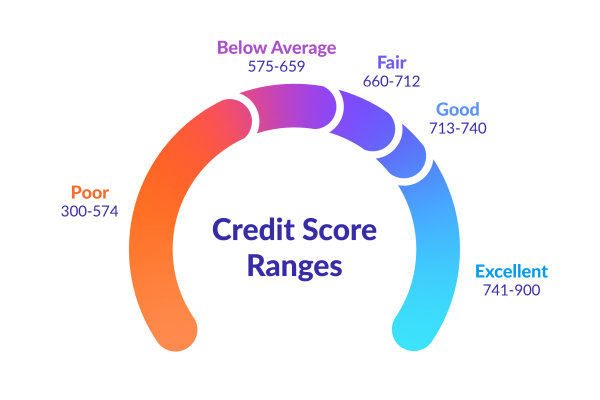

Unemployed But Good Credit Score

If you have a very high credit score and it appears your unemployment will be temporary, a lender may overlook your current situation. Much depends on your career as some skills are more in demand than others.

If you have a long, positive payment history, this can count for a lot. As is being in an in-demand career. While nothing is ever guaranteed, it can help your situation considerably.

If you don’t have stellar credit, you will find it much more difficult to access a car loan until you find work. C

Use a Co-Signer

You could always use a co-signer if you really need a car loan. You could ask someone to guarantee the loan and come in to sign to say they will take over the loan if you miss a payment.

You’ll need to know someone who trusts you enough to co-sign the loan and who has a sufficient credit score to qualify it but it’s an option.

Not All Bad News

It isn’t all bad news though. We work with a few lenders willing to offer car loans to those who have new jobs. If you find work and it’s a full-time, permanent role, you can apply for a car loan almost immediately.

This won’t help you while you’re unemployed but it can help you while looking for work.

Actually, it will help you while you’re unemployed by not giving you something else to worry about while you don’t have income, but that’s another story.

As soon as you get your offer letter or formal notice of being hired, you can use that, along with evidence of savings, proof of ID and address and bank statements, to apply for a car loan.

We can help you get preapproved and help you prepare your application so it stands the highest chance of success.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval