Finding The Best Car Financing Deals in Canada: 5 Key Tips

Finding The Best Car Financing Deals in Canada: 5 Key Tips

Posted on January 7, 2024

Securing the best car financing deal in Canada requires a strategic approach and a keen understanding of the financial landscape. Whether you're a first-time buyer or looking to upgrade your vehicle, finding favorable car financing deals can significantly impact your overall ownership experience.

In this article, we'll explore key tips and considerations to help you discover and secure the best car financing deals in Canada.

1. Research and Compare Lenders:

Start your journey by researching and comparing various lenders, including banks, credit unions, and online financial institutions.

Each may offer different interest rates, terms, and conditions. Utilize online tools and resources to compare financing options and identify lenders with competitive deals.

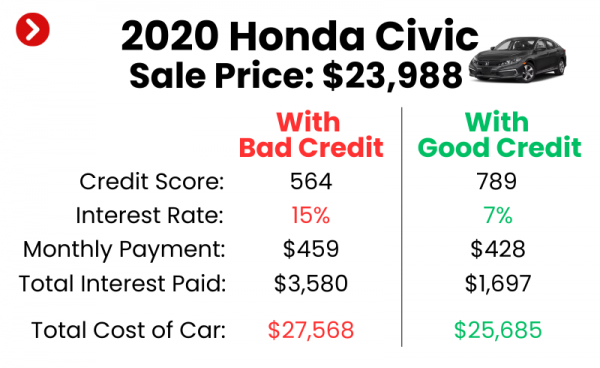

2. Creditworthiness

Understand your creditworthiness before applying for car financing. A higher credit score often translates to better interest rates.

Obtain a copy of your credit report, address any discrepancies, and work on improving your credit score if needed.

3. Special Promotions and Incentives

Keep an eye out for special promotions and incentives offered by manufacturers, dealerships, or lenders.

These promotions may include lower interest rates, cashback options, or extended warranty periods. Be aware of any time-sensitive offers and capitalize on them.

4. Online Comparison Tools

Utilize online comparison tools and platforms dedicated to car financing. These tools can help you quickly assess and compare financing deals from multiple lenders, allowing you to make an informed decision based on your financial goals.

Check out Allstate.com's auto loan comparison calculator here.

5. Consider the Total Cost of the Loan:

Instead of solely focusing on the monthly payments, consider the total cost of the loan. Some financing deals may offer lower monthly payments but come with higher overall interest costs.

Assess the total amount paid over the loan term to make an accurate comparison.

6. Pre-Approval

Getting pre-approved for a car loan provides you with a clear understanding of your budget and strengthens your negotiating position. Lenders may offer pre-approved applicants more favorable terms, making it a strategic step in securing the best financing deal.

We offer pre-approval at Unique Chrysler. Click here to get pre-approved and find out how much you can finance!

7. Explore Manufacturer Financing

Some car manufacturers provide in-house financing options through their affiliated financial services. Explore these options, as they may offer exclusive deals, special rates, or unique incentives that can enhance your overall financing experience.

8. Read the Fine Print

Carefully review the terms and conditions of any financing deal before committing. Pay attention to fees, penalties for early repayment, and any clauses that may affect the flexibility of your loan. Being well-informed will help you avoid any surprises down the road.

You're Ready!

Finding the best car financing deals in Canada requires a combination of research, negotiation, and understanding your own financial situation.

By comparing lenders, leveraging your creditworthiness, and exploring promotional offers, you can secure a financing deal that aligns with your budget and enhances your overall car ownership experience.

Remember to stay informed, be proactive in negotiations, and prioritize terms that best suit your financial goals.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval