What to Know About Financing a Car in Canada: 5 Expert Tips

What to Know About Financing a Car in Canada: 5 Expert Tips

Posted on January 15, 2024

When it comes to purchasing a car in Canada, most people will need to consider financing options. Car financing is an excellent way to spread out the cost of a vehicle over time, making it more affordable for the average Canadian.

However, there are a few things to keep in mind when it comes to car financing in Canada. Here's what you need to know:

1. Your Credit Score Matters

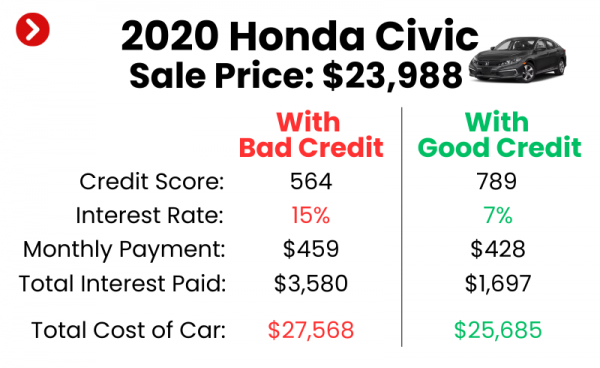

One of the most important things to consider when it comes to car financing is your credit score. Your credit score is a reflection of your financial history, including any debts you may have and how well you've paid them off in the past.

In Canada, the minimum credit score required to qualify for car financing is usually around 650. However, if your score is lower than that, you may still be able to secure financing, but you may need to pay a higher interest rate.

2. You Have Options

When it comes to car financing in Canada, you have a few different options to choose from. The most common option is a car loan, which is a type of installment loan that you can use to finance the purchase of a vehicle.

You'll typically be required to make monthly payments on the loan, including interest and fees until the loan is paid off in full.

Alternatively, you may also be able to lease a car, which allows you to make monthly payments on the vehicle for a set period. However, at the end of the lease, you'll need to return the vehicle or purchase it for a predetermined price.

3. Interest Rates Vary

When it comes to car financing, interest rates can vary widely depending on a number of factors, including your credit score, the type of vehicle you're purchasing, and the length of the loan.

In general, however, interest rates for car loans in Canada tend to be between 4% and 8%, although they can be higher or lower depending on your individual circumstances.

4. Down Payments are Important

In most cases, you'll be required to make a down payment when you finance a car in Canada. The amount of the down payment will depend on a variety of factors, including the type of vehicle you're purchasing and your individual financial situation.

Typically, down payments range from 10% to 20% of the total purchase price of the vehicle.

5. You Can Negotiate

Finally, it's important to remember that car financing is negotiable. Don't be afraid to shop around for the best rates and terms, and be prepared to negotiate with lenders to get the best deal possible. In addition, if you're buying a vehicle from a dealership, be sure to negotiate the price of the car as well as the financing terms to get the best overall deal.

In conclusion, car financing in Canada can be a great way to purchase a vehicle and spread out the cost over time. However, it's important to keep these key factors in mind when considering your options.

By understanding your credit score, exploring your financing options, being aware of interest rates and down payment requirements, and negotiating with lenders, you can secure the best financing terms for your needs and budget.