How Do Car Loans Work In Ontario? All Your Questions Answered

How Do Car Loans Work In Ontario? All Your Questions Answered

Posted on March 15, 2025

If you have never borrowed money before or have always paid cash for your cars, the world of auto loans may seem a little confusing at first. It’s simple once you understand what’s going on though.

We asked our auto loans team to outline the very basics of auto loans, how they work, how to qualify and how to successfully pay it off.

How do Car Loans Work in Ontario?

Auto loans are simple. You borrow a fixed amount over a fixed term at a fixed interest rate. The loan is secured on the car and that car will only be truly yours once the loan is paid off.

Make all your payments on time and you’re free and clear after the final payment. Miss a payment or more than one and the lender can take action, including repossessing the car. While auto loans are fixed, most allow you to overpay or settle early if your circumstances change.

How to Prepare for an Ontario Auto Loan

Like most things in life, an auto loan is mainly about the preparation. Research, preparing paperwork, budgets and all those things that mean car shopping is a much more enjoyable experience.

Here’s what you need to do.

Check Your Credit Score

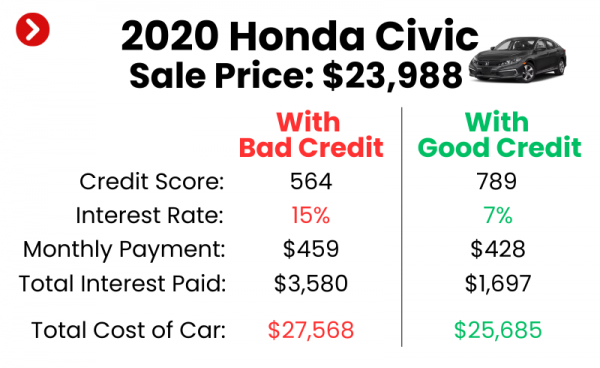

Lenders use your credit score to assess whether you’re a low or high-risk borrower. The higher your score, the lower your perceived risk and the more likely you are to be given the loan. You’ll get a lower interest rate too.

Lower credit scores will be assessed more closely but can still qualify. The interest rates will be higher as you are perceived to be a higher risk.

Check Your Paperwork

You will need paperwork to qualify for the loan. You will need proof of ID, of address, proof of income and earnings, proof of any savings, bank statements to show your income and outgoings, and perhaps other paperwork too depending on your situation.

The lender will assess your application and use that paperwork to verify what you say is true. It’s nothing personal, it’s just how the system works. Here's a full list of the documents needed to buy a car.

Get Pre-Approved

Auto loan prequalification helps you find out if you can afford the amount you want to borrow and shows you how much it will cost over the term of the loan and each month.

Prequalification uses a soft inquiry on your credit report so won’t make a difference to your score. Auto loan preapproval is a step further. It’s like getting a quote for a loan and should only be used once you have a good idea that you might like to apply for the loan.

Preapproval uses a hard inquiry on your credit report, which other lenders can see and can ding your score slightly. That’s why we only recommend using them when you’re ready to get a loan. Click here to get pre-approved with us today!

Work With Auto Loan Experts

Once you have prepared your paperwork, have an idea of what you could borrow and a budget, it’s time to work with the experts.

Our Halton auto loans team has vast experience in helping new borrowers qualify for car loans and in securing competitive rates.

Come see what we can do for you!

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.