Car Loan As a Student In Canada: Everything To Know In 2025

Car Loan As a Student In Canada: Everything To Know In 2025

Posted on January 19, 2025

Securing a car loan as a student in Canada can be a challenging yet necessary step for those seeking the convenience and independence that come with owning a vehicle. While there may not be specific student programs or credit union options discussed in this article, understanding the general landscape of car loans for students is crucial.

This article aims to provide insights into the considerations, challenges, and potential solutions associated with obtaining a car loan in Canada as a student.

What to Consider When Trying to Finance a Car Loan as a Student

Credit Score

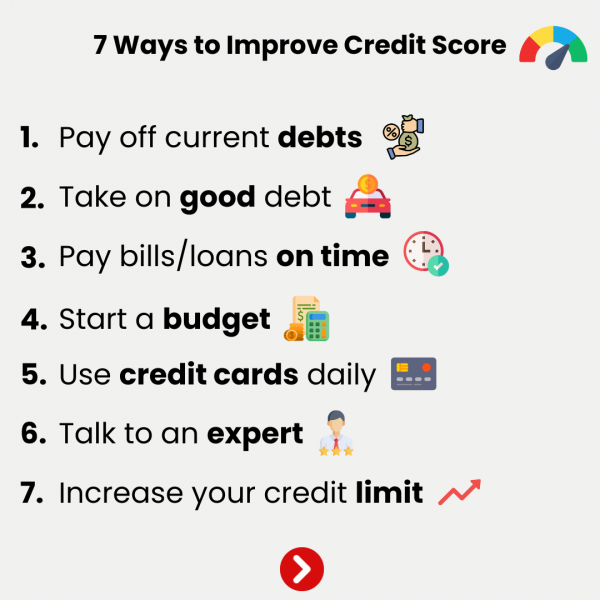

As a student, you might not have an extensive credit history, and this can impact your eligibility for a car loan. Lenders typically consider credit scores when evaluating loan applications.

Building a positive credit history by paying bills on time and being responsible with credit cards can improve your chances of approval.

Income and Employment

Lenders will assess your ability to repay the loan, which often depends on your income and employment status. Part-time or full-time employment, co-op programs, or internships can strengthen your application. A stable income is a reassuring factor for lenders.

Down Payment

Saving for a down payment demonstrates financial responsibility and reduces the amount you need to borrow. A higher down payment can improve your loan terms, such as interest rates and repayment periods.

Interest Rates

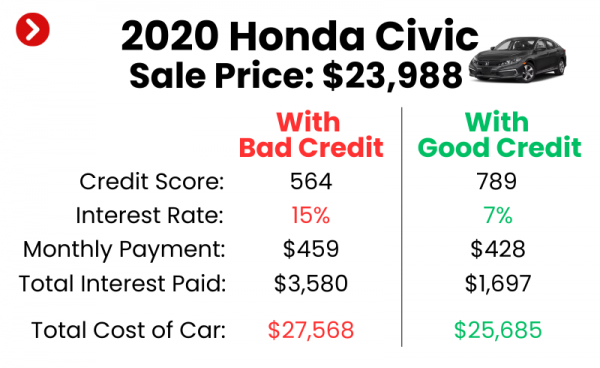

Interest rates for car loans can be higher for individuals with limited credit history. Shopping around for the best rates from various financial institutions is essential. Online tools and resources can help compare rates and terms offered by different lenders.

Loan Terms

The length of the loan term can affect monthly payments. While longer terms may result in lower monthly payments, they can also lead to higher overall interest costs. Finding a balance that suits your budget and financial goals is crucial.

Cosigner

Having a cosigner with a stable financial history can increase your chances of approval. A cosigner essentially guarantees the loan in case you are unable to make payments. This can be a parent, guardian, or another trusted individual.

Challenges of Financing a Car Loan as a Student

Limited Income

Students often face limited income, making it challenging to meet the financial requirements of a car loan. Prioritizing a part-time job or exploring income-generating opportunities can address this challenge.

High-Interest Rates

Limited credit history may result in higher interest rates. While this can increase the cost of the loan, making timely payments and improving your credit score can open doors to refinancing options with better rates in the future.

Loan Denial

Some students may face loan denials due to insufficient income, credit issues, or other factors. Exploring alternative financing options, such as private lenders or financing through the dealership, may be necessary.

The Right Steps to Getting Approved

Building Credit

Initiating and maintaining good credit practices, such as paying bills on time and using credit responsibly, can gradually improve your credit score. This, in turn, enhances your eligibility for favorable loan terms.

Part-Time Employment

Taking on part-time work or exploring income-generating opportunities during your studies can supplement your finances and strengthen your loan application.

Used Cars

Considering a used car instead of a new one can reduce the overall cost of the loan. Used cars typically have lower price tags, resulting in smaller loan amounts and potentially more favorable terms.

To find out whether or not you should be buying a used car, check out our article here.

Your Journey Starts Here

Securing a car loan as a student in Canada involves careful consideration of various factors, from credit history to income and loan terms. Taking a proactive approach to financial management, exploring employment opportunities, and understanding the intricacies of the loan process can help pave the way toward car ownership.

By addressing challenges and making informed decisions, students can navigate the car loan landscape in Canada successfully.

If you're ready for a car loan, we'd love to help with that! simply fill in the form below to get started.

Car Loan Pre-Approval